Employers in the UK are required to pay workers at least the National Living Wage (NLW) or National Minimum Wage (NMW) for their age. We will have a new minimum wage when the rates are increased from 1 April 2024. The NLW is extended to workers aged 21 and above from that date.

What date do the new minimum wage rules come into force?

Employers must pay workers the new NLW or NMW rate for their age with effect for pay reference periods starting on or after 1 April 2024. In this article we outline when the different rates are payable and the new rates applying from 1 April 2024.

National Living Wage

The NLW is the highest rate of the NMW. Currently, workers aged 23 and above must be paid at least the NLW. However, for pay reference periods beginning on or after 1 April 2024, you must pay workers aged 21 and above at least the NLW.

The NLW is set at £10.42 per hour from 1 April 2023 to 31 March 2024. It is increased to £11.44 per hour from 1 April 2024.

National Minimum Wage

Workers who have reached school leaving age but who are not yet old enough for the NLW must be paid the NMW for their age. From 1 April 2023 to 31 March 2024, there are three levels of the NMW – one for workers aged 21 and 22, which is set at £10.18 per hour, one for workers aged 18 to 20, which is set at £7.49 per hour, and one for workers who have reached school leaving age and who are under the age of 18, which is set at £5.28 per hour.

From 1 April 2024, there are only two NMW rates as from that date workers aged 21 and above are entitled to the NLW. The rate for workers aged 18 to 20 is set at £8.60 per hour and the rate for workers who have reached school leaving age and who are under the age of 18 is set at £6.40 per hour.

Apprentice rate

A separate rate applies to apprentices who are under the age of 19, or over the age of 19 but in the first year of their apprenticeship. This is set at £5.28 per hour from 1 April 2023 to 31 March 2024 and at £6.40 per hour from 1 April 2024.

Apprentices over the age of 19 must be paid at least the NLW or NMW rate for their age if they have completed the first year of their apprenticeship.

Accommodation offset

If you provide your workers with accommodation, this can be considered when working out the worker’s pay for NLW or NMW purposes. If the accommodation is provided for free, the accommodation offset is added to the worker’s pay when determining whether they are being paid at least the NLW or NMW for their age.

The accommodation offset is set at £9.10 per day (£63.70 per week) from 1 April 2023 to 31 March 2024. It is increased to £9.99 per day (£69.93 per week) from 1 April 2024.

However, unless accommodation is deemed necessary for the performance of duties or usual for the type of employment (e.g. vicar looking after a parish, manager above a pub or agricultural workers on a farm), it is likely that the provision of the accommodation will also lead to a taxable benefit in kind for the employee

Directors and other office holders

In most cases directors are classified as office holders, and as long as they do not have a contract with their company that classifies them as “workers”, the NMW will not apply.

Penalties

The penalties payable if you fail to implement the increases in NMW and NLW from 1 April 2024, can be severe. The government increased the penalties imposed on employers that underpay their workers in breach of the minimum wage legislation from 100% to 200% of arrears owed to workers. The maximum penalty that can be charged per worker is £20,000.

New Minimum Wage – Summary

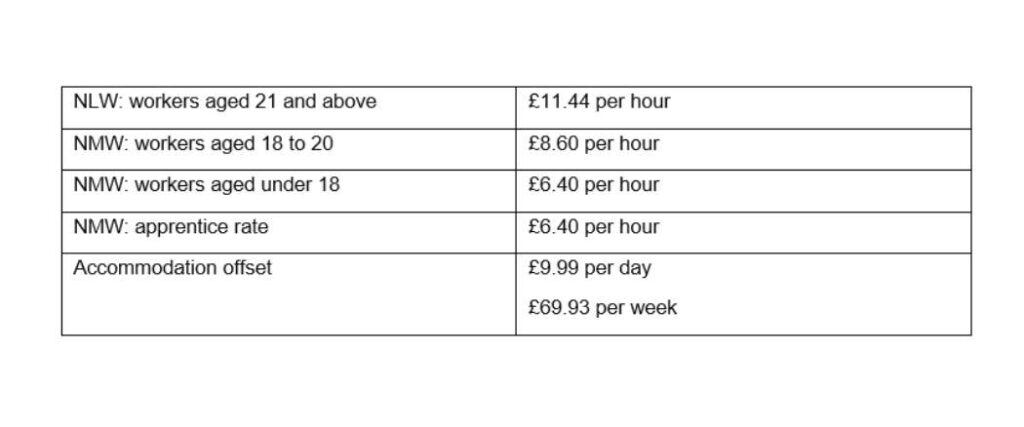

The rates applying for pay reference periods starting on or after 1 April 2024 are shown in the following table.

If you would like to speak to a member of our team about how the new minimum wage might impact upon you or your business please contact us. HMRC also have a range of information available on their website in connection with the new minimum wage and you can find that here. Please contact us on 020 7870 9050 or email us at hello@rpgcc.co.uk if you would like to speak to a member of our team.